About the Data

Coverage

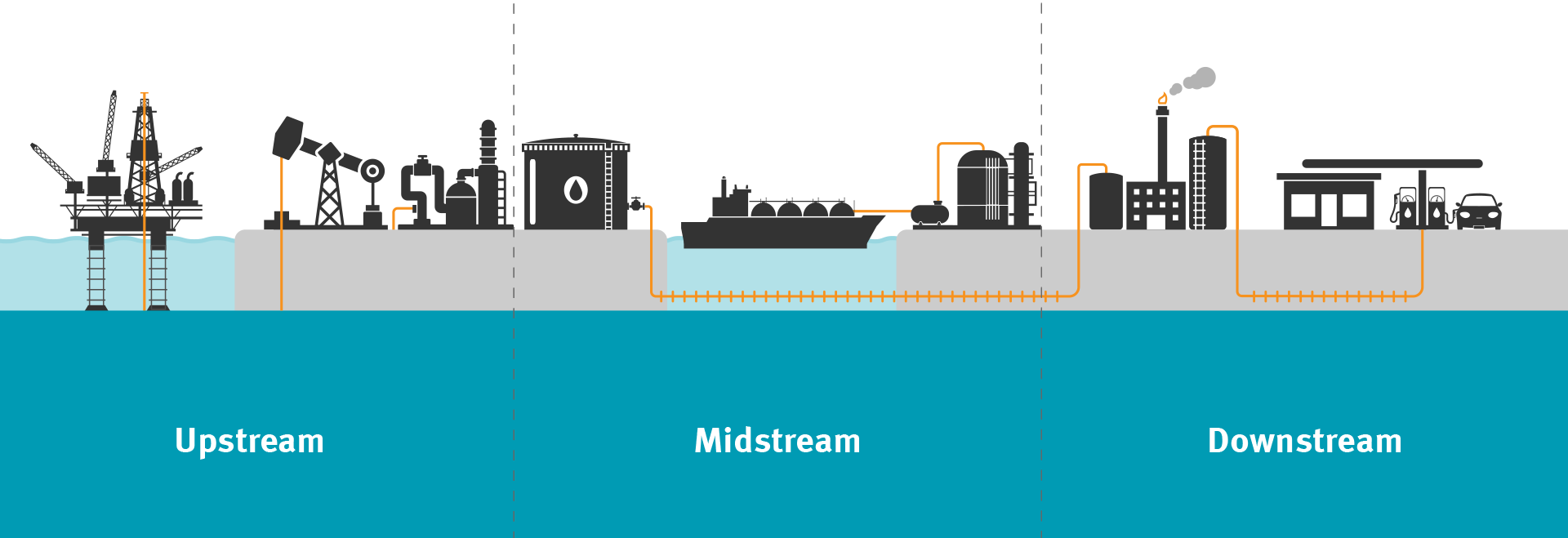

GOGEL contains data on the upstream, midstream and power subsectors of the oil & gas industry. The database covers

- 95% of oil & gas production

- 98% of short-term upstream expansion

- 684 companies exploring for new oil & gas resources

- 469 companies responsible for midstream expansion

- 809 gas- and oil-fired power developers

- 390 companies linked to 33 reputational risk projects on 5 continents.

GOGEL Inclusion Thresholds

The inclusion thresholds determine which companies will eventually be listed on GOGEL. They aim to capture the industry's expansion plans in the upstream, midstream and gas-fired power sectors, as well as companies' upstream production activities with a special focus on unconventionals. In the upstream section, the thresholds are designed to reach >90% coverage of worldwide production, expansion and exploration activities. At the same time, the thresholds keep the amount of companies manageable and ensure the entities in the database are relevant industry players.

Upstream Thresholds

Production

All companies that in the previous year produced

≥ 20 mmboe of oil & gas and/or

≥ 2 mmboe of oil & gas

in one of 6 unconventional categories

Short-Term Expansion

All companies that intend to add

≥ 20 mmboe of oil & gas resources to their production portfolio

Exploration

All companies that spent

≥ USD 10 million on average annually on exploration over the last 3 years

Midstream Thresholds

Expansion

All companies developing

≥ 100 km of pipelines

All companies developing

≥ 1 Mtpa of annual LNG terminal capacity

Power Thresholds

Expansion

All companies developing

≥ 100 MW of gas-fired power capacity and/or

≥ 100 MW of oil-fired power capacity

Expansion Metrics

GOGEL features several unique data points that allow users to "look into the future" by revealing companies' upstream and midstream expansion plans. GOGEL is the first tool that makes it possible to systematically assess whether a company’s activities are in line with the IEA Net-Zero Emissions Scenario [NZE]. In its “Net Zero by 2050” report from 2021, which was updated in 2022, the IEA specifies a pathway for the energy sector to limit global temperature rise to 1.5 °C. The report clearly states, “No fossil fuel exploration is required in the NZE [Net-Zero Emissions Scenario] as no new oil and natural gas fields are required beyond those that have already been approved for development.” (IEA Net Zero by 2050)

IEA NZE Expansion Overshoot

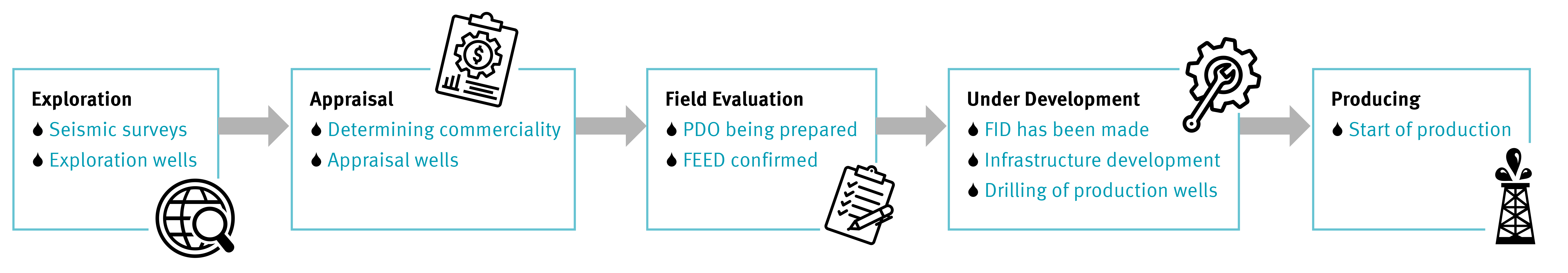

The GOGEL IEA NZE Expansion Overshoot metric includes all oil & gas resources, which were approved for development after December 31, 2021 or are currently in the process of being approved (field evaluation). Keeping these oil and gas resources in the ground and ending exploration is the bare minimum of what is needed to keep 1.5 °C attainable.

Exploration CAPEX

GOGEL includes figures on the average amount of money a company spent on exploration activities in the past 3 years (Exploration CAPEX). Exploration is the first stage in the life cycle of an oil & gas asset and involves searching for resources that can only start producing many years from now. This means that all exploration activity is incompatible with the IEA NZE scenario and other pathways aimed at limiting global warming to 1.5 °C.

Unconventional Expansion

The unconventional expansion metric depicts the percentage of a company’s short-term expansion plans in GOGEL’s 6 unconventional categories, as well as Oil Shale (Kerogen). As production from easily accessible, conventional fields stagnates, oil and gas companies are replacing them with unconventional oil and gas resources. Unconventionals pose a greater threat to people and the environment and are usually more expensive to extract than conventional oil & gas.

Short-Term Expansion

The GOGEL Short-Term Expansion metric states the amount of resources companies are actively seeking to bring into production in the near future. It includes all oil & gas resources that either have been approved for production or are in the process of being approved. Even if oil & gas companies abandon all short-term expansion plans today, currently producing fields would provide oil & gas for many years to come.

Midstream Expansion

GOGEL lists companies responsible for the development of new pipelines and new LNG terminal capacity. Midstream expansion is often connected to upstream expansion because increased transport capacity can enable oil & gas companies to increase production. Moreover, midstream infrastructure will only pay off if it operates for several decades. This means that new pipelines and LNG terminals are threatening to lock the world into a high-emissions pathway. In a world where global warming is limited to 1.5 °C, this infrastructure is useless.

O&G Power Expansion

This section of GOGEL presents data on gas- and oil-fired power developers. Similar to midstream expansion projects, gas- and oil-fired power projects increase long-term dependency on fossil fuels and create incentives for upstream expansion. Due to methane leaks and other emissions related to the extraction and transportation of natural gas either through pipelines or as liquefied natural gas (LNG), natural gas can be just as harmful to the climate as coal or oil.

Reputational Risk Projects

Oil & gas projects have many adverse effects beyond greenhouse gas emissions. They can trigger or exacerbate violent conflicts and harm communities and the environment. Local communities protest projects or challenge them in court. Oil & gas projects can quickly turn into a reputational risk for their financial backers, such as banks, investors and insurers.

GOGEL links companies to reputational risk projects that fall within one or more of 4 reputational risk categories: (1) social harm; (2) environmental destruction; (3) conflict/violence; and (4) litigation. Information on reputational risk projects comes from Urgewald’s extensive network of partner organizations. The reputational risk projects are linked to the companies listed with quantitative data on GOGEL, but other companies can also have stakes in the projects. The list of reputational risk projects is not conclusive and is updated regularly.

Sources

GOGEL relies on a variety of data sources. The information on current oil & gas production, production percentages and upstream expansion is based on quantitative data obtained from Rystad Energy. The other part of the upstream data is based on company data sources, like annual reports, financial statements and investor presentations. In some cases, we also use information from government agencies or stock exchanges.

The midstream and power segments of GOGEL use company and government sources as well as information from Global Energy Monitor (GEM) to identify and attribute ownership to expansion projects.

The descriptions of the Reputational Risk projects rely on different sources, like NGO reports, independent research institutions, reliable news outlets and information from partner organizations.

Work in Progress

GOGEL is work in progress. The database will be updated each fall and also expand over time. In future iterations of GOGEL, we aim to further improve our coverage and include additional subsectors of the oil & gas industry.